If you think of bonds as stodgy investments that are only suitable for the proverbial widows and orphans, you’re sorely misinformed.

Highly rated bonds certainly have well-earned reputations for safety, providing steady interest payments and all but guaranteeing repayment of principal. That makes them an integral part of any balanced investment plan, because they constitute the ballast to help offset volatility that exposure to stocks can generate.

Highly rated bonds certainly have well-earned reputations for safety, providing steady interest payments and all but guaranteeing repayment of principal. That makes them an integral part of any balanced investment plan, because they constitute the ballast to help offset volatility that exposure to stocks can generate.

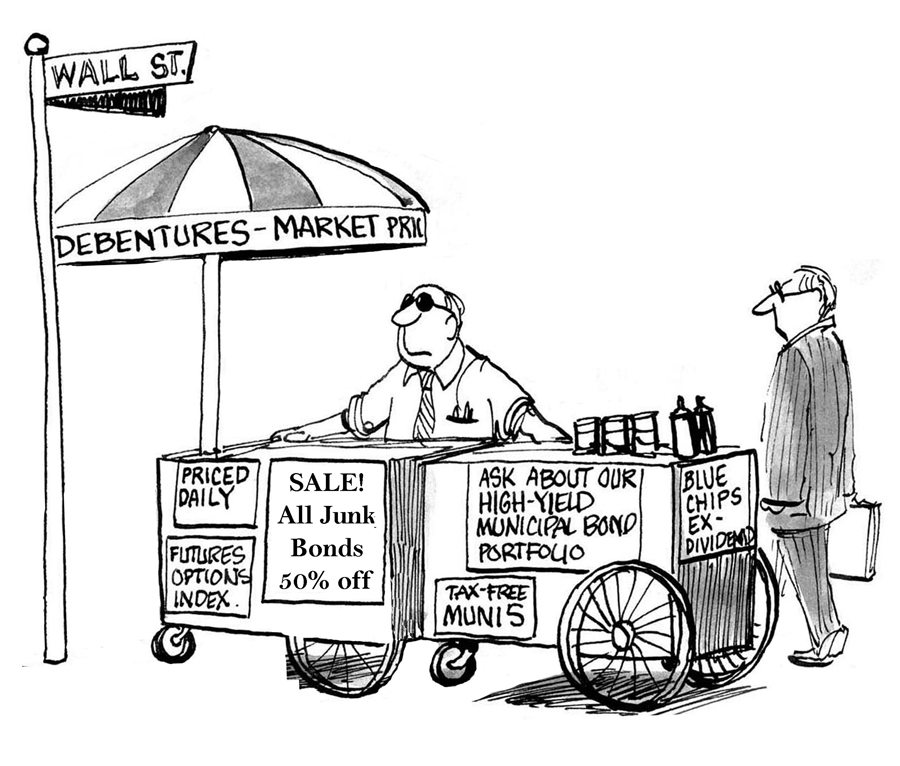

The abundance of choices — and risks — available to bond investors, however, belies the reputation of the bond market as stodgy. So-called “junk bonds,” for instance, or the lowest-rated corporate bonds, can spark the type of stomach-churning thrills most commonly associated with equity shares in newly minted technology startups.

Simply put, bonds are loans to corporations, governments or government agencies. Bonds are known as “fixed-income” investments because the issuer of a bond has agreed to pay a predetermined — or fixed — amount of interest on a scheduled basis, and then to pay back the face value of the bond at its maturity date. The U.S. Department of the Treasury issues bonds on behalf of the federal government. A city or state may issue bonds to help pay for new roads, schools or other projects. Corporations sell bonds to fund expansion into new markets, build factories or simply increase cash flow.

There are many considerations when investing in the bond market. Among the most important, which will be discussed below, are the term, or time frame, of a bond, its rating — meaning the perceived likelihood of default — and the taxable status of a bond’s interest payments. Interest generated by corporate bonds is subject to federal and state income taxes. But interest from municipal bonds, or “munis,” which is shorthand for bonds issued by states as well as by municipal governments, is often tax-exempt, depending on where an investor resides.

Another decision for investors is whether to buy individual bonds or shares of a bond mutual fund. By going the mutual fund route, investors can diversify their bond holdings even if they only have a relatively small amount of money to invest, and they don’t have to research individual bonds themselves. Unlike individual bonds, however, bond mutual funds don’t guarantee specific interest rates, mature on specific dates or promise repayment of principal.

But before weighing such tradeoffs or evaluating other important facets of the bond market, prospective bond investors must understand the relationship between bond prices, bond yields and interest rates.

Deciphering the ‘inverse relationship’

Bonds generally are issued in increments of $1,000 and, as previously stated, they mature on specific dates and pay fixed interest rates. The face value of a bond is called its “par value” and the stated interest rate is called its “coupon rate.” A bond paying 5% annual interest has a coupon rate of 5%.

(Fun fact: Bonds used to be issued with detachable coupons that were mailed in or otherwise presented to the issuer of the bond in order to collect an interest payment.)

But not all bonds are owned by a single investor from the time they’re issued by a corporation or government until the date they mature and repay par value. Instead, many are traded among investors on the so-called secondary market, so their market price moves up and down depending on conditions in the broad economy, the rate of inflation, the perceived financial stability of the issuer and other factors.

It’s important to keep in mind that the yield on a bond sold on the secondary market — or the amount an investor actually earns — moves inversely, or opposite, to the market price of the bond.

In other words, if a bond is trading on the secondary market above its par value, the yield earned by an investor who opts to buy it will be below the bond’s fixed coupon rate.

Here’s an example:

You pay $11,000 for a 5-year bond with a par value of $10,000 and a coupon rate of 5%. If you hold the bond to maturity, you will reap an annual yield of about 2.7%, not the 5% fixed coupon rate.

Your interest payment from the issuer will be $500 annually and you’ll be repaid $10,000 upon maturity. But the yield on your investment will work out to less than the coupon rate because you paid what’s know as a premium, or more than par value, for the bond.

Similarly, if you buy a bond at a discount, or pay less than par, your yield to maturity would be higher than the bond’s fixed coupon rate.

So, why would an investor pay more than par? There can be many reasons, but one is that the investor is confident in the financial stability of the bond issuer and wants to lock up some cash for a fixed amount of time at a competitive yield. In the above example, a yield of 2.7% is substantially higher than could be earned by simply parking the money in a savings account.

Interest rates in the broad economy are a major driver of bond prices on the secondary market. If interest rates rise in the broad economy, the coupon rates of new bonds generally will move higher as well. As a result, the market prices of previously issued bonds carrying lower coupon rates generally fall, because investors on the secondary market won’t pay as much for bonds with lower coupon rates when they can buy similar bonds with higher rates.

Conversely, when interest rates fall, the market price of older, previously issued bonds generally rise on the secondary market. A bond with a 5% coupon rate is going to be worth more to investors when new bonds are being issued with, say, 4% coupon rates.

Bear in mind, you don’t have to pay much attention to the market price of a bond after you buy it if you’re content with the yield on your investment and intend to hold your bond until maturity.

Despite fluctuations in your bond’s value on the secondary market, if you simply hold on to it you will be paid your fixed interest payments and then be repaid par value upon maturity — the only caveat being, of course, that the issuer doesn’t default.

One factor you do need to consider is inflation, because it eats into the purchasing power of the fixed interest payments that bonds make over time. If you buy a 10-year bond yielding 4% annually, but the inflation rate ticks up to 2% annually from 1% during that time period, you’ll end up with substantially less real purchasing power.

Fear factor

When you lend money to anyone, the biggest risk is you’ll never see it again. Bond investors face the same hazard. A bond is said to be in default if it fails  to make its fixed interest payments to investors or doesn’t repay par value upon maturity. That’s where ratings agencies come in. The agencies — such as Standard & Poor’s Ratings Service and Moody’s Investors Service — basically grade bonds according to the likelihood that they’ll be able to live up to their obligations and stay out of default.

to make its fixed interest payments to investors or doesn’t repay par value upon maturity. That’s where ratings agencies come in. The agencies — such as Standard & Poor’s Ratings Service and Moody’s Investors Service — basically grade bonds according to the likelihood that they’ll be able to live up to their obligations and stay out of default.

The grades, known as credit ratings, are based on the overall financial condition of a corporation or government issuing a bond, the amount of debt the issuer already has incurred, the pace of its sales and profit growth (if it’s a corporation), the condition of the economy and other factors.

Bonds deemed to be of good quality are called “investment grade.” According to S&P’s grading system, investment-grade bonds are rated BBB or higher, while Moody’s rates them Baa or higher. Bonds issued by governments and corporations deemed to be exceptionally stable and the least risky carry AAA ratings from S&P and Aaa ratings from Moody’s — in both cases three notches in their scales above the minimums for investment grade.

In general, the higher a bond’s credit rating, the lower the interest rate it offers. The reverse also is true, with low-rated bonds generally offering higher interest rates. The logic is straight out of Econ 101— investors must be enticed to take on greater risk with the prospect of greater reward.

Bonds with the poorest, non-investment grade ratings are colloquially known as junk bonds, because they’re deemed to be speculative and to have a higher-than-average risk of default. Junk bonds also are referred to as “high-yield bonds,” because of the relatively hefty interest rates they offer investors willing to take the risk.

Occasionally, bonds are issued with investment-grade ratings but then are downgraded by the ratings agencies at some point before the maturity date because of unforeseen deterioration in the issuer’s financial condition. When that happens, the price of the bonds sinks on the secondary market as the perceived risk of default rises, which causes the yield to rise. An upgrade generally fuels the opposite reaction, with prices on the secondary market climbing and yields falling.

Ol' reliable

The U.S. government is widely considered the most stable and reliable borrower on the planet (a notion that may amuse anyone keeping tabs on recent U.S. political discourse), so debt obligations issued by the U.S. Treasury — collectively referred to as Treasuries — are the standard against which many other bonds are judged.

So-called T-bills issued by the Treasury are short-term debt maturing in a year or less. Treasury notes, on the other hand, have intermediate terms of two, three, five, seven or 10 years, while Treasury bonds carry longer terms of more than 10 years. Interest on Treasuries is subject to federal income taxes, although it’s exempt from state and local income taxes.

Because the U.S. is considered such a safe bet not to default, Treasuries yield less than other bonds of identical maturities. Many bond investors closely monitor yields on Treasuries — such as the 10-year and 30-year Treasury bonds — as benchmarks to gauge the amount of default risk they must take on to earn more than they could get simply by sticking with the essentially risk-free U.S. government debt.

In addition to conventional Treasuries, the U.S. offers another type of debt that can help investors guard against the stealth impact of inflation on purchasing power.

Treasury inflation-protected securities, or TIPS, are bonds issued by the U.S. Treasury. Unlike conventional Treasuries, the principal invested in TIPS is adjusted up or down to reflect the rate of inflation as measured by the Consumer Price Index. The interest payments on TIPS, then, vary with the adjusted principal, with higher inflation resulting in higher interest payments and vice versa.

Bonds issued by states, cities and local government agencies — or muni bonds — are another popular option for investors. Munis can be especially attractive to high-income investors because their interest payments are exempt from federal income taxes, as well as from state income taxes if investors live in the state where the bonds were issued.

There are two main types of muni bonds — general obligation, or GO, bonds, which are backed by the “full faith and credit” of the issuer, and revenue bonds, which are backed by user fees generated by a particular government project, such as a toll road or power plant. GO bonds typically are considered safer because a local government can raise taxes if necessary to avoid default, whereas revenue bonds are backed by single revenue streams.

Still, both types of muni bonds generally are reliable investments, although it’s wise to research the states and municipalities before buying their bonds.

Investors face myriad choices in the corporate bond market, ranging from bonds issued by blue-chip companies with top-notch credit ratings to the debt of teetering operators just hoping to stay afloat.

Remember, if you come across a corporate bond that’s paying an outsized yield relative to other corporate bonds of similar maturity, there’s a reason for it. And it has to do with default risk. It’s essential to research a corporation and check credit ratings before buying a corporate bond. Also, keep in mind that interest payments from corporate bonds are subject to federal and state income taxes.

It’s your call

In general, the longer a bond’s term, the higher the interest rate it pays. Again, the reason is basic economics — investors demand higher rewards as compensation for the risk of tying up money for longer periods of time. But long-term bonds aren’t for everyone. You should assess your financial outlook and cash needs before deciding to buy a short-, intermediate- or long-term bond.

Some bonds also have a “call” feature that investors must be aware of. While all bonds have a stated maturity date, some are “callable” as well, meaning the issuer has the right to pay back par value at an earlier date if they so chose. Issuers of callable bonds typically will exercise the right if, on the specified call date, prevailing market interest rates are lower than they were when the bonds were issued. Just like a homeowner opting to refinance, the issuer will take the opportunity to save money by paying off its older, high-interest debt and then issuing new bonds at the new, lower rate.

You can assess a callable bond before you buy it by looking up its stated “yield to call,” which is a calculation of yield if an investor were to buy a callable bond and hold it until its call date. Of course, it’s not a given that a bond will be called, because it largely depends on the movement of interest rates in the broad economy after the bond was first issued.

One popular strategy in bond investing is called “laddering,” in which an investor buys a number of bonds of staggered maturities. The idea is that the bonds will mature at regular intervals and then the proceeds will be available for reinvestment in new bonds or for cash needs. The strategy diversifies a bond portfolio, and it helps investors guard against the potential for a liquidity crunch that can come when money is tied up for fixed periods of time.

If you only have a small amount of money to invest in bonds, or you simply don’t want to spend your time researching individual bonds, mutual funds are a good option. There are as many categories of bond mutual funds as there are individual bonds — from funds that invest only in munis to funds that invest only in corporate debt, and everything in between. Total bond market index funds, as their name indicates, are the most diverse offerings.

It’s true that your principal can decline when you invest in a bond mutual fund, particularly during a period of rising interest rates. But if you invest in a good one and hold on to it long enough, your interest payments are likely to offset the decline, and you’ll also benefit as your fund manager reinvests principal from maturing bonds in new bonds paying higher interest.